The global cashew market is experiencing increased demand due to rising health consciousness, the plant-based movement, changing consumption patterns, and shifts in the global supply chain.

The Sweet and Salty Truth About the Global Cashew Market: A Comprehensive Analysis of Demand, Pricing, and Competition

Cashews, with their rich and creamy taste, have become a popular snack and ingredient in cuisines around the world. But how did these delicious nuts gain such popularity? The history of cashews can be traced back to Brazil, where they were first discovered by Portuguese explorers in the 16th century. From there, cashews spread to other parts of the world, including India, Africa, and Southeast Asia.

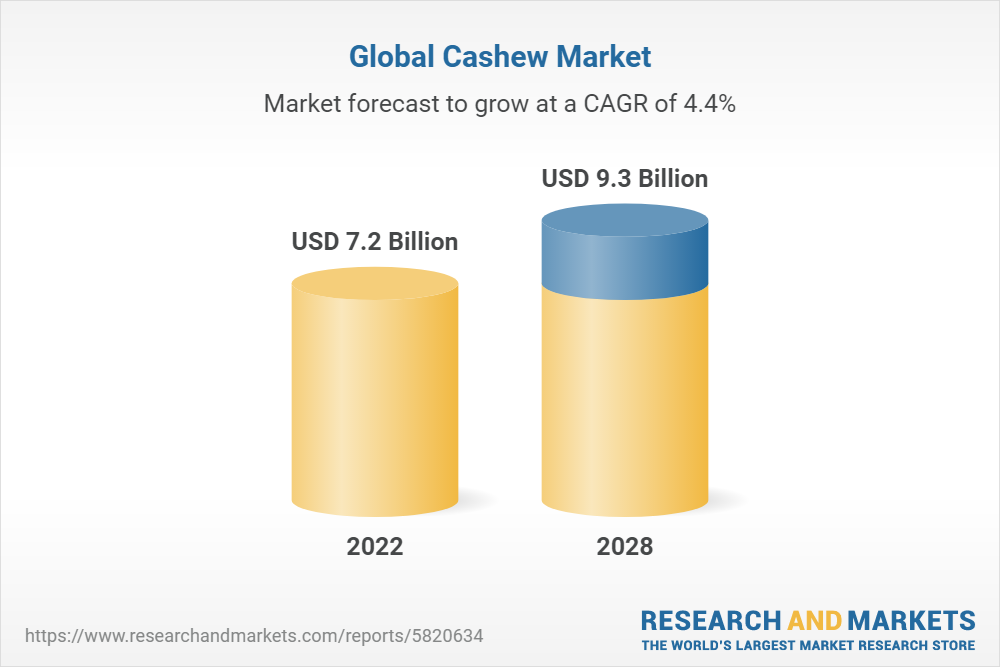

Today, cashews are one of the most widely consumed nuts globally. They are not only enjoyed as a snack but also used in various culinary applications, such as in desserts, stir-fries, and nut butters. The global cashew market has seen significant growth over the years, driven by increasing consumer demand and the versatility of cashews in different cuisines.

The Economic Impact of the Cashew Industry: A Look at the Numbers

The cashew industry plays a significant role in the global economy. According to statistics, the global cashew market was valued at over $10 billion in 2020 and is projected to reach $15 billion by 2026. This growth can be attributed to several factors, including rising disposable incomes, changing dietary preferences, and increased awareness about the health benefits of cashews.

The cashew industry also provides employment opportunities and income generation for millions of people worldwide. In countries like India, Vietnam, and Brazil, where cashew production is high, it serves as a vital source of livelihood for farmers and workers involved in the cultivation, processing, and distribution of cashews. Additionally, the industry supports ancillary sectors such as transportation, packaging, and retail.

Cashew Nut Production Comparison: India, Vietnam, and Brazil

| Feature | India | Vietnam | Brazil |

|---|---|---|---|

| Rank (Global Production) | 1 | 2 | 3 |

| Production (Tonnes) (2022 Estimate) | 674,600 | 1,272,000 | 220,000 |

| Market Share (Global) | 24% | 45% | 8% |

| Climate | Tropical Monsoon | Tropical Monsoon | Tropical Savanna |

| Cashew Growing Areas | Kerala, Maharashtra, Goa, Karnataka | Binh Phuoc, Dak Lak, Dong Nai, Khanh Hoa | Ceara, Bahia, Piaui, Rio Grande do Norte |

| Farming Practices | Mostly small-scale farms | Mix of small and large-scale farms | Mostly large-scale farms |

| Strengths | Well-established processing industry | High productivity and efficient processing | Favorable climate for cashew growing |

| Weaknesses | Lower yields compared to Vietnam | Reliance on rain-fed agriculture | Limited processing capacity compared to Vietnam |

| Exports | Major exporter of cashew kernels | Major exporter of cashew kernels | Smaller exporter of cashew kernels |

Understanding the Cashew Supply Chain: From Farm to Consumer

The cashew supply chain involves several stages from farm to consumer. It starts with cashew cultivation on farms, where farmers grow cashew trees and harvest the cashew apples. The cashew nuts are then extracted from the apples and undergo a series of processing steps, including drying, roasting, and shelling. Once processed, the cashews are sorted, graded, and packaged for distribution.

Key players in the cashew supply chain include farmers, processors, exporters, importers, wholesalers, and retailers. Each player has a specific role to play in ensuring the smooth flow of cashews from the farm to the consumer. However, challenges exist at each stage of the supply chain, such as fluctuating prices, quality control issues, and logistical constraints.

Rising Demand

- Health-Conscious Consumers: The rise of health and wellness awareness fuels demand for cashews due to their nutritional profile (protein, fiber, healthy fats).

- Plant-Based Trend: The growth of vegan, vegetarian, and flexitarian diets drives demand for cashew-based products like cashew milk, cheese, yogurt, and other dairy alternatives.

- Snacking Culture: Cashews are a popular and convenient snack choice, aligning with the increasing demand for healthy, portable options.

Shift in Consumption

- Developing Markets: Emerging economies like India and China are seeing a significant rise in cashew consumption, previously concentrated in North America and Europe.

- Snackification: Cashews are finding wider applications in snacks, baked goods, and confectionary, with savory and spicy flavors gaining popularity.

- Value-Added Products: There’s increased focus on innovative products like cashew butter, cashew-based dips, and sauces, expanding the market beyond raw and roasted cashews.

Supply-Chain Dynamics

- Production Shifts: West Africa is emerging as a significant cashew growing region, supplementing traditional producers like Vietnam and India.

- Processing Power: Vietnam remains the dominant processing hub, while India focuses on boosting its domestic processing capacity.

- Sustainability Focus: There’s growing pressure for sustainable cashew production practices, including fair trade certifications, water conservation, and reduced deforestation.

The Role of Developing Countries in the Cashew Market: Opportunities and Challenges

Developing countries play a significant role in the global cashew market. Countries like India, Vietnam, Brazil, and Ivory Coast are among the top producers and exporters of cashews worldwide. These countries have favorable climatic conditions for cashew cultivation and have invested in infrastructure and technology to boost production.

However, developing countries also face several challenges in the cashew industry. Limited access to capital and technology, lack of market information, and inadequate infrastructure are some of the hurdles that hinder their growth potential. Additionally, fluctuations in global prices and competition from other cashew-producing countries pose challenges for these nations.

The Impact of Climate Change on Cashew Production: A Growing Concern

Climate change poses a significant threat to cashew production worldwide. Cashew trees are sensitive to changes in temperature and rainfall patterns, making them vulnerable to climate-related risks such as droughts, floods, and pests. These factors can lead to reduced yields and poor quality nuts.

To mitigate the impact of climate change on cashew production, farmers and stakeholders in the industry are adopting various strategies. These include implementing sustainable farming practices, such as agroforestry and water conservation techniques. Additionally, research is being conducted to develop climate-resilient cashew varieties that can withstand extreme weather conditions.

The Rise of Organic and Fair Trade Cashews: A New Trend in the Market

In recent years, there has been a growing demand for organic and fair trade cashews. Organic cashews are produced without the use of synthetic pesticides or fertilizers, while fair trade cashews ensure that farmers receive fair prices for their produce and adhere to social and environmental standards.

Consumers are increasingly conscious about the origin and production methods of the products they consume, leading to the rise in demand for organic and fair trade cashews. These products offer several benefits, including better taste, higher nutritional value, and support for sustainable farming practices and fair wages for farmers.

The Competitive Landscape of the Cashew Industry: Key Players and Market Share

The global cashew market is highly competitive, with several key players vying for market share. Some of the major players in the industry include Olam International, Archer Daniels Midland Company, John B. Sanfilippo & Son, Inc., and Bazzini Holdings LLC.

Market share among these players varies depending on factors such as production capacity, distribution networks, product quality, and brand reputation. These companies invest in research and development to introduce new products and improve processing techniques to stay ahead in the market.

Market Landscape:

- Concentration: The global cashew industry, particularly processing, is relatively concentrated within a few major players. This influences the market dynamics and bargaining power throughout the supply chain.

- Processing vs. Production: There’s a distinction between major raw cashew nut producers (Vietnam, West Africa) and major processors/exporters (Vietnam, India). This division affects prices and availability within the overall market.

- Growing Demand: Rising demand, especially in health-conscious markets and for alternative dairy products, increases competition for raw cashews.

Major Players:

- Olam International: One of the largest agribusinesses globally, with a significant presence throughout the cashew value chain. They operate in origination (sourcing of raw cashew nuts), processing, and export. Their wide network gives them significant market influence.

- Archer Daniels Midland Company (ADM): A major commodities trader and processor. Their involvement in cashews, although not as extensive as Olam, gives them a role in sourcing, distribution, and the creation of cashew-based products.

- John B. Sanfilippo & Son, Inc. (JBSS): A US-based focused primarily on the distribution and retail of cashew products within North America. They influence that market sector, though their sourcing comes from the larger global players.

- Bazzini Holdings LLC: Another major North American nut trader and processor. Like JBSS, their focus is on final packaged goods, but their sourcing and processing activities affect the broader cashew market.

The Effect of Government Policies on the Cashew Market: Trade Agreements and Tariffs

Government policies play a crucial role in shaping the cashew market. Trade agreements between countries can impact cashew exports and imports, affecting market dynamics. Tariffs imposed on cashew imports can also influence prices and trade volumes.

For example, in 2019, the United States imposed tariffs on cashew imports from Vietnam as part of a trade dispute (because the US administration asserted that Vietnam was undervaluing its currency to create an unfair trade advantage. The tariffs did not solely target cashews. They applied a wide range of products imported from Vietnam.).

This led to a decline in Vietnamese cashew exports to the U.S. market and an increase in prices. Such policy changes can have significant implications for cashew-producing countries and exporters.

The Role of Technology in Cashew Processing and Packaging: Innovations and Trends

Technology has played a vital role in improving cashew processing and packaging techniques. Innovations such as automated sorting machines, advanced drying methods, and vacuum packaging have helped enhance efficiency, reduce losses, and maintain the quality of cashews.

Trends in technology adoption in the cashew industry include the use of artificial intelligence and machine learning algorithms for quality control, robotics for shelling and sorting, and blockchain technology for traceability and transparency in the supply chain. These advancements not only improve productivity but also ensure food safety and meet consumer expectations.

The Consumer Perspective: Trends and Preferences in Cashew Products

Consumer trends and preferences play a significant role in shaping the cashew market. Health-conscious consumers are increasingly opting for natural and nutritious snacks, making cashews a popular choice. The demand for flavored cashews, such as honey-roasted or spicy varieties, is also on the rise.

- Flavorful Variations: Plain cashews are still popular, but there’s a surge in demand for cashews seasoned with spices, herbs, and various flavor profiles – from sweet and salty to smoky and spicy.

- Cashew Butters and Spreads: Cashew butter is emerging as a nut butter alternative for people with peanut allergies. It offers a creamy texture and a unique flavor profile.

- Cashew-Based Dips and Sauces: Cashews are being used as a base for dips and sauces, creating vegan and vegetarian options with a rich and creamy texture.

Factors influencing consumer choices include taste, quality, price, packaging, and brand reputation. Consumers are also becoming more aware of ethical considerations, such as fair trade and sustainability practices. As a result, there is a growing demand for organic and fair trade cashews.

The Future of the Cashew Market and Its Potential for Growth

The future of the cashew market looks promising, with opportunities for growth in both developed and developing countries. Rising consumer demand, increasing awareness about the health benefits of cashews, and the popularity of organic and fair trade products are expected to drive market growth.

However, challenges such as climate change impacts, competition among key players, and government policies can pose hurdles for the industry. To overcome these challenges, stakeholders need to invest in research and development, adopt sustainable farming practices, improve supply chain efficiency, and cater to evolving consumer preferences.

Overall, the cashew industry has a bright future ahead, with potential for innovation, expansion, and economic development. As consumers continue to embrace cashews as a healthy and versatile snack, the market is poised for continued growth in the coming years.

Originally posted 2024-04-05 11:10:00.